Loan Application Process

A simple, transparent, and efficient process to get your housing loan approved quickly

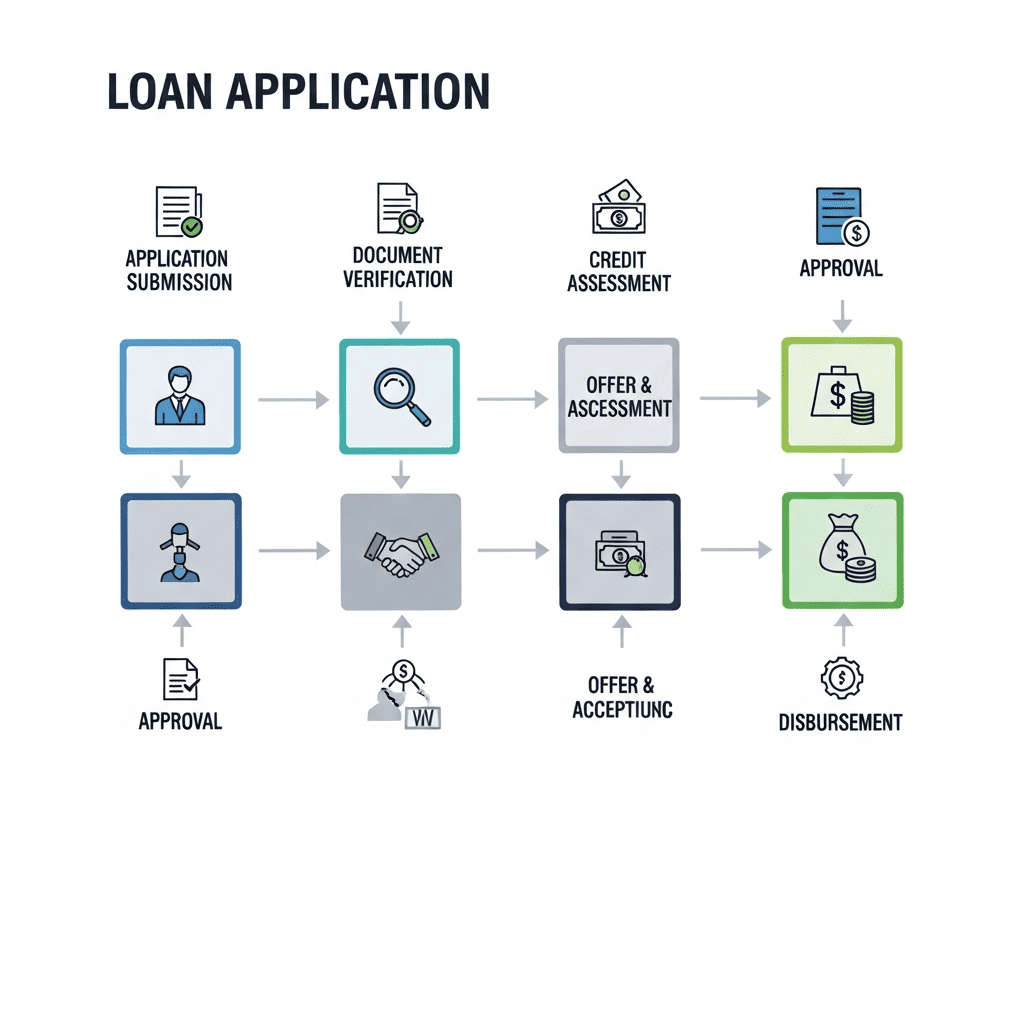

Process Overview

Our streamlined application process ensures quick approval and disbursement of your housing loan

Applying for a housing loan with Adani Housing Finance is simple and straightforward. Our process is designed to be transparent, efficient, and customer-friendly, ensuring you get the best service experience.

From initial application to final disbursement, we guide you through each step, keeping you informed about the progress. Our dedicated relationship managers are available to assist you throughout the journey.

Detailed Step-by-Step Process

Follow these steps to complete your loan application successfully

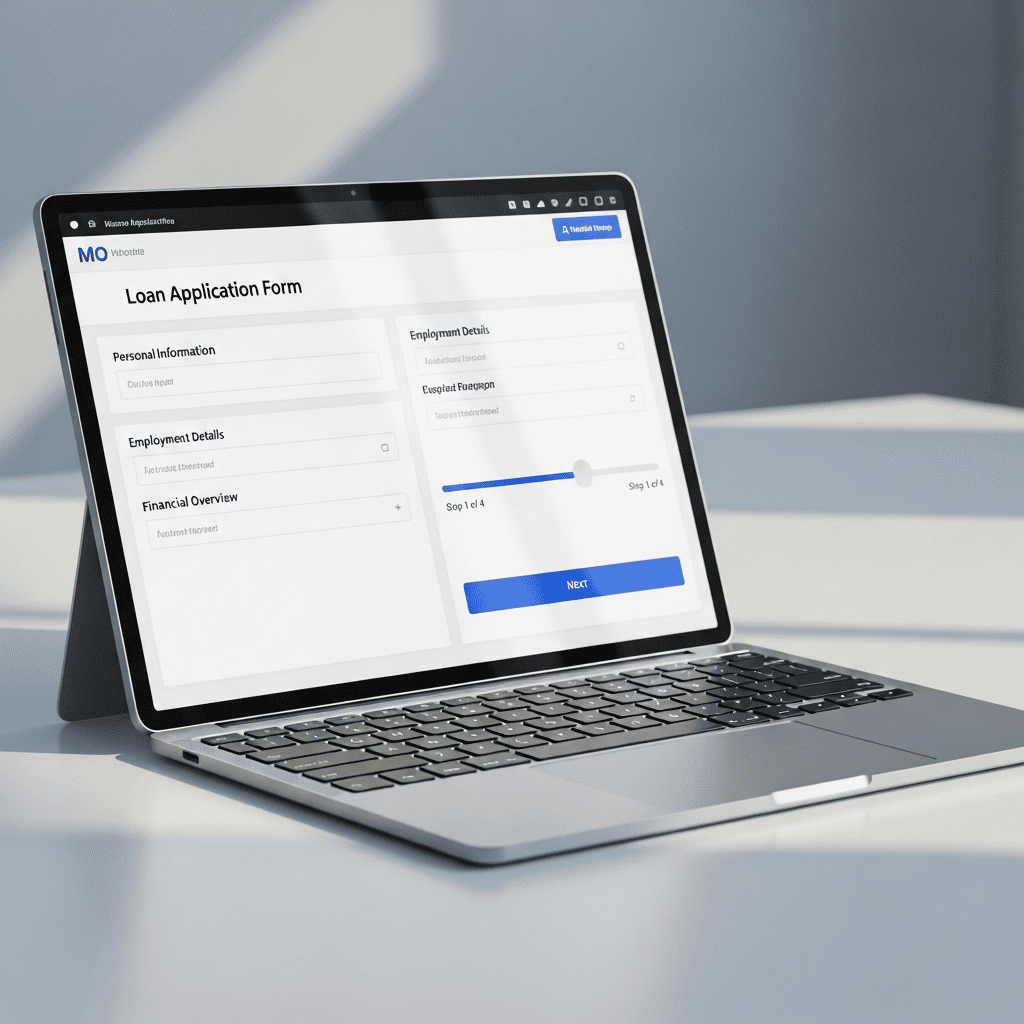

Application Submission

Submit your loan application online or visit our branch. Fill in your personal, financial, and property details. Our online application form is user-friendly and takes only 10-15 minutes to complete.

- Online application available 24/7

- Branch visit option available

- Dedicated support for assistance

Document Collection

Submit all required documents as per our checklist. Our relationship manager will guide you through the documentation process and verify all documents for completeness.

- Document checklist provided

- Digital document upload facility

- Physical document submission option

Verification & Assessment

We verify your documents, assess your creditworthiness, and evaluate the property. This includes credit bureau checks, income verification, and property valuation.

- Credit score evaluation

- Income verification

- Property valuation

Loan Approval

Upon successful verification, your loan is approved. You will receive a sanction letter detailing the loan amount, interest rate, tenure, and terms & conditions.

- Sanction letter issued

- Loan terms communicated

- Acceptance confirmation required

Legal & Technical Processing

Legal verification of property documents and technical evaluation are completed. This ensures all property-related formalities are in order before disbursement.

- Legal document verification

- Property title check

- Technical evaluation

Loan Disbursement

Once all formalities are completed, the loan amount is disbursed directly to the builder/seller account or as per the agreed terms. You can start your homeownership journey!

- Direct disbursement to builder/seller

- Milestone-based disbursement for construction

- EMI schedule provided

Time Frame & Milestones

Expected timeline for each stage of the loan application process

Application Submission

Submit application and initial documents

Document Verification

Complete document collection and verification

Credit Assessment

Credit check and income verification

Loan Approval

Sanction letter issued upon approval

Legal Processing

Property document verification and legal formalities

Loan Disbursement

Final disbursement of loan amount

Start Your Application

Apply for your housing loan online in just a few simple steps. Our online application is secure, fast, and convenient.

Track Your Application

Monitor your loan application status in real-time through our online portal

Online Portal

Access your application status anytime, anywhere through our secure online portal using your application ID.

Email & SMS Updates

Receive instant notifications via email and SMS at every stage of your application process.

Customer Support

Contact our customer support team for any queries or assistance regarding your application status.

Check Application Status

Enter your application ID to track your loan application status