Products & Services

Comprehensive housing finance solutions tailored to meet your unique homeownership needs

Product Overview

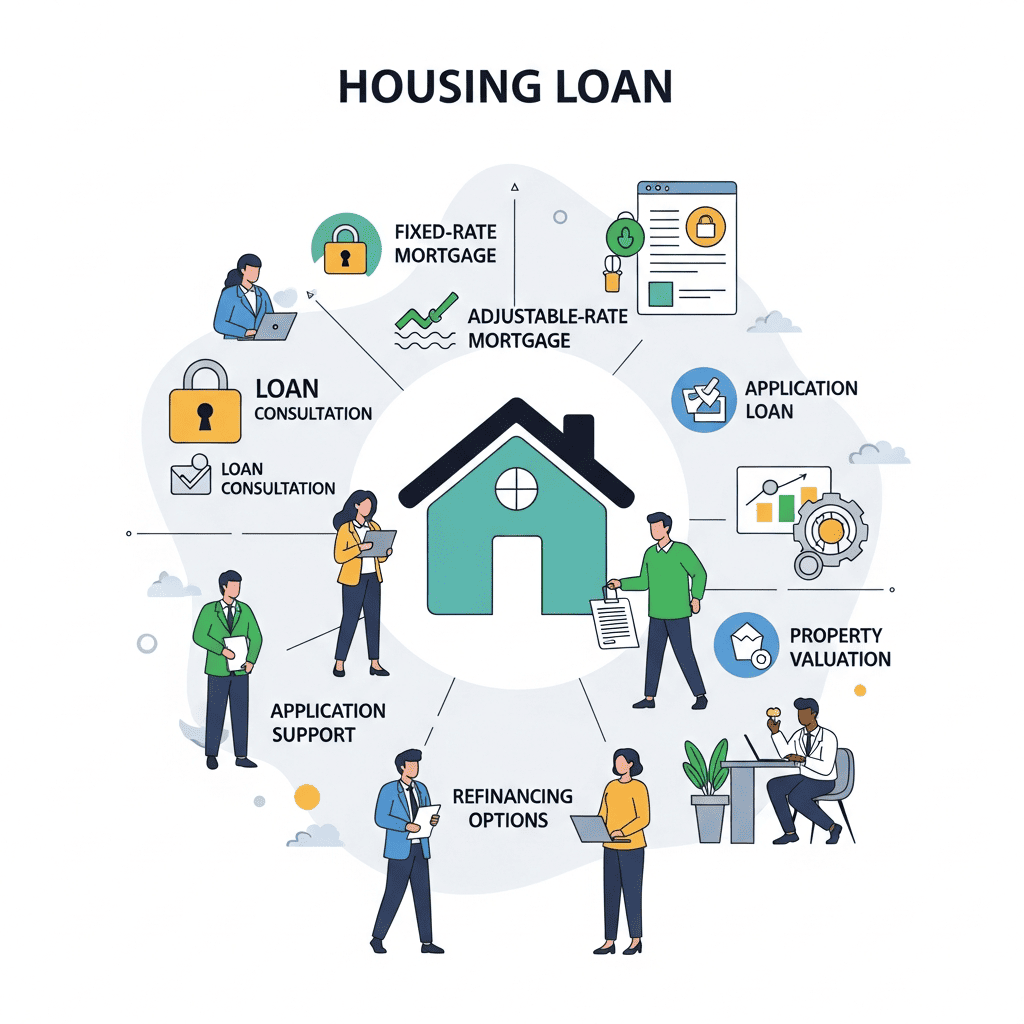

We offer a wide range of housing finance products designed to make your homeownership journey smooth and affordable

At Adani Housing Finance, we understand that every customer has unique financial needs and aspirations. Our comprehensive suite of housing finance products is designed to cater to diverse requirements, from first-time homebuyers to experienced property investors.

Whether you're looking to purchase a new home, buy a resale property, or construct your dream house, we have the right loan product for you. Our flexible repayment options, competitive interest rates, and personalized service ensure that your homeownership dream becomes a reality.

Main Loan Product Types

Explore our range of housing finance products designed for different needs

New Home Purchase

Finance your dream new home with our competitive rates and flexible repayment options. Perfect for first-time buyers and property investors.

- Loan amount up to ₹5 crores

- Interest rates from 8.5% p.a.

- Tenure up to 30 years

- Quick approval process

Resale Home Purchase

Quick and hassle-free financing for purchasing pre-owned properties. Simplified documentation and fast processing.

- Loan amount up to ₹3 crores

- Interest rates from 8.75% p.a.

- Tenure up to 25 years

- Property valuation support

Home Construction

Build your own home with our specialized construction finance. Flexible disbursement based on construction milestones.

- Loan amount up to ₹5 crores

- Interest rates from 8.5% p.a.

- Milestone-based disbursement

- Technical support included

Service Features

What makes our services stand out in the housing finance industry

Fast Processing

Quick loan approval and disbursement within 7-10 working days after document verification.

Dedicated Relationship Manager

Personalized service with a dedicated relationship manager to guide you through the entire process.

Online Application

Apply for loans online with our user-friendly digital platform. Track your application status in real-time.

Transparent Process

Complete transparency with no hidden charges. Clear terms and conditions explained upfront.

Flexible Repayment

Choose from various repayment options including step-up, step-down, and flexible EMI plans.

24/7 Customer Support

Round-the-clock customer support to assist you with any queries or concerns.

Product Comparison

Compare our loan products to find the best fit for your needs

| Features | New Home Purchase | Resale Home Purchase | Home Construction |

|---|---|---|---|

| Maximum Loan Amount | Up to ₹5 Crores | Up to ₹3 Crores | Up to ₹5 Crores |

| Interest Rate (p.a.) | 8.5% - 12% | 8.75% - 12.5% | 8.5% - 12% |

| Maximum Tenure | 30 years | 25 years | 30 years |

| Loan-to-Value Ratio | Up to 90% | Up to 85% | Up to 90% |

| Processing Fee | 0.5% - 1% | 0.5% - 1% | 0.5% - 1% |

| Prepayment Charges | Nil after 1 year | Nil after 1 year | Nil after 1 year |

Frequently Asked Questions

Find answers to common questions about our housing finance products

What documents are required for a home loan application?

You will need identity proof (Aadhaar, PAN card), address proof, income documents (salary slips, IT returns), property documents, and bank statements. For detailed requirements, please visit our application process page.

What is the minimum and maximum loan amount I can avail?

The minimum loan amount is ₹5 lakhs, and the maximum can go up to ₹5 crores depending on the property value, your income, and eligibility criteria. Loan amount is typically up to 90% of the property value for new homes.

How long does it take to get loan approval?

Once all required documents are submitted and verified, loan approval typically takes 3-5 working days. Disbursement happens within 7-10 working days after approval, subject to property documentation completion.

Can I prepay my home loan? Are there any charges?

Yes, you can prepay your home loan partially or fully. There are no prepayment charges after the first year of loan disbursement. You can make prepayments through our online portal or by visiting our branch.

What is the interest rate on home loans?

Interest rates start from 8.5% per annum and vary based on loan amount, tenure, credit profile, and property type. Rates are competitive and reviewed periodically. Contact us for current rates applicable to your profile.

Can I transfer my existing home loan to Adani Housing Finance?

Yes, we offer home loan balance transfer facility. You can transfer your existing home loan from another lender to enjoy better interest rates and service. Contact our relationship manager to understand the process and benefits.